A diploma in taxation legislation is often a degree programme that covers differing types of calculations and number manipulation. Besides this, candidates are required to Possess a keen eye for details.

A business need to have an ABN if it is needed to sign up for GST (see over, Intake taxes). All other businesses may well decide on irrespective of whether to obtain an ABN.

After the closing merit list is posted, the prospect should full the doc verification course of action and spend the fees.

The study part consists of a mix of theoretical learning, realistic case experiments, discussions, and workshops. Students delve into tax codes, laws, and rulings, enabling them to research tax implications, structure transactions, and suggest purchasers effectively. They also obtain useful insights into tax compliance procedures and reporting demands. Overall, the DTL course equips students with the necessary expertise and skills to navigate the elaborate and dynamic discipline of taxation legislation proficiently.

This course is part of the next degree system(s) offered by University of Illinois Urbana-Champaign. If you are admitted and enroll, your completed coursework may count toward your degree learning and your development can transfer with you.¹

Finance jobs, mainly taxation kinds, are sure to raise with the rise in entrepreneurship society within the business entire world. The normal income for a professional in taxation and finance is all around Rs. five LPA or earlier mentioned.

Despite the fact that our analysis guides are selective, inclusion of a web-site or source would not constitute endorsement because of the Law Library of Congress. Not one of the information in almost any of our investigation guides is legal information.

Upcoming, the course explores important subnational topics not encountered during the study of federal corporate income taxes, for example federal limitations around the powers of subnational governments to tax. To close the course, the student will likely be introduced with a case study along with a comparative law Investigation that will provide them insight into analytical methods employed by interdisciplinary tax teams designed-up of international, federal and subnational tax specialists assigned to deal with company restructurings.

The Point out and Territory revenue authorities are listed below, with one-way links to all of read more their taxing legislation on their own official legislation websites, and in certain cases to their revenue rulings and cases.

Taxes are generally not levied retroactively, other than in Exclusive instances. One particular example of retroactive taxation was the taxation of wartime benefits in a few European countries by legislation enacted in 1945 once the war and enemy occupation were over.

Additionally, a licence is generally needed to undertake actions in relation to excisable goods.

A tax consolidation regime also applies for one hundred% owned group companies, allowing them to consolidate income for the whole team and dismiss transactions within the group for your reasons of income tax.

This postgraduate course syllabus is sort of the exact same in all universities and colleges in India. The syllabus is as follows.

Presented their rapid expansion and economic clout, It's not astonishing that private fairness resources and hedge money have captivated escalating attention while in the tax-writing committees of Congress.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Andrew Keegan Then & Now!

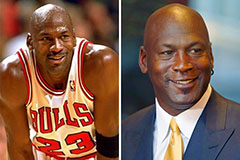

Andrew Keegan Then & Now! Michael Jordan Then & Now!

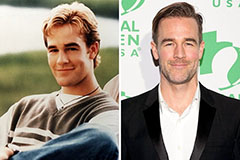

Michael Jordan Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Batista Then & Now!

Batista Then & Now!